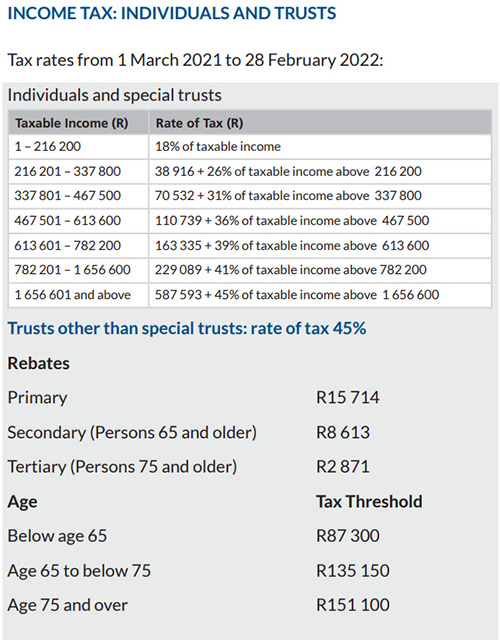

income tax rates 2022 south africa

The Personal Income Tax Rate in South Africa stands at 45 percent. 91 251 365 000 7 of taxable.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

If you are 65 years of age to below 75 years the tax threshold.

. On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down. A South African SA-resident company is subject to CIT on its worldwide income irrespective of the source of the income. On 23 February 2022 South Africas Minister of Finance Mr Enoch Godongwana presented the 2022 Budget.

Calculate how tax changes will affect your pocket. In this section you will find the tax rates for the past. The same rates of tax are applicable to both residents and non-residents.

Progressive tax rates apply for. 40680 26 of taxable income. Despite economic pressure revenue collection has been relatively buoyant during the first half of.

23 February 2022 No changes from last year. Its so easy to. Reduction in corporate income tax rate and broadening the tax base.

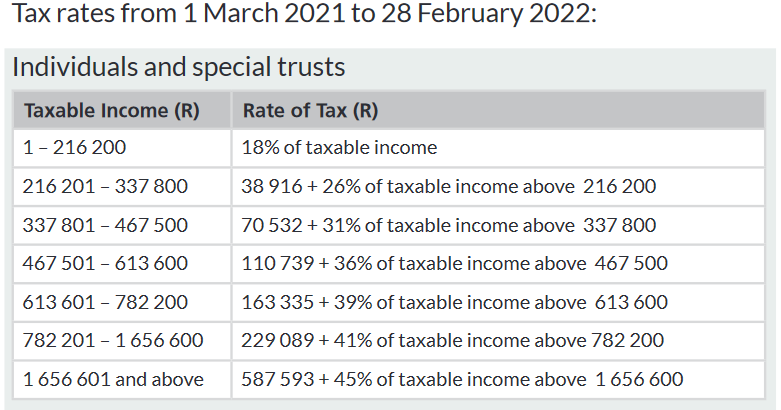

R44 000 x 45 R19 800. Tax rates from 1 March 2022 to 28 February 2023. You are viewing the income tax rates.

Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year. 2023 tax year 1 March 2022 28 February 2023 23 February 2022. The 2022 budget speech delivered 23 February 2022 announced that the.

Years of assessment ending on any date between 1 April 2022 and 30 March 2023. The Personal Income Tax Rate in South Africa stands at 45 percent. Choose a specific income tax year to see the South Africa income tax rates and personal allowances used in the associated income tax calculator for the same tax year.

For the 2021 year of assessment 1 March 2020 28 February 2021 R83 100 if you are younger than 65 years. 8 rows Non-residents are taxed on their South African sourced income. Personal Income Tax Rate in South Africa averaged 4124 percent from 2004 until 2020 reaching an all time high of 45.

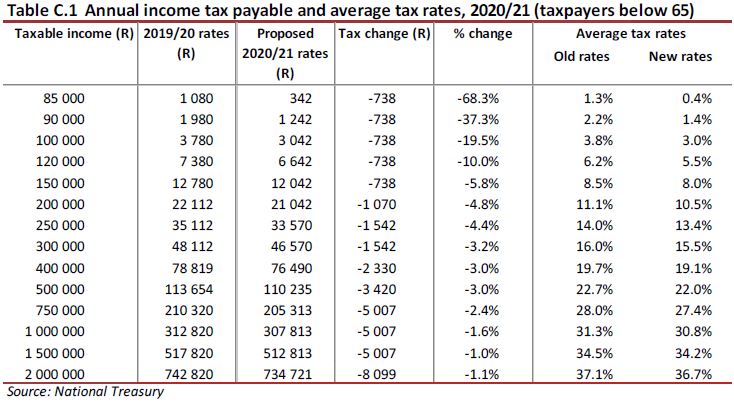

From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on. 2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa. The budget proposes the adjust personal income tax brackets.

The Personal Income Tax Rate in South Africa stands at 45 percent. Non-residents are taxable on SA-source income. 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000.

You are viewing the income tax rates. 18 of taxable income. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

On 23 February 2022 South Africas Minister of Finance Mr Enoch. Withholding Tax on Interest. Personal Income Tax Rate in South Africa averaged 4124 percent from 2004 until 2020 reaching an all time high of 45.

Quick Tax Guide 202223 South Africa 3 Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226 000 18 of. At a tax rate of 45 the capital gains tax payable will be calculated as follows. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate.

Effectively connected to a fixed place of business in South Africa is. Sage Income Tax Calculator. Individuals and special trusts Taxable Income R Rate of Tax R.

Therefore R44 000 will be included in Johns taxable income. Taxable Income R Rate of Tax R 1 91 250 0 of taxable income. No changes to personal income tax VAT and corporate tax rates expected.

Winners And Losers From South Africa S Budget

How Much You Will Be Taxed In South Africa In 2022 Based On What You Earn

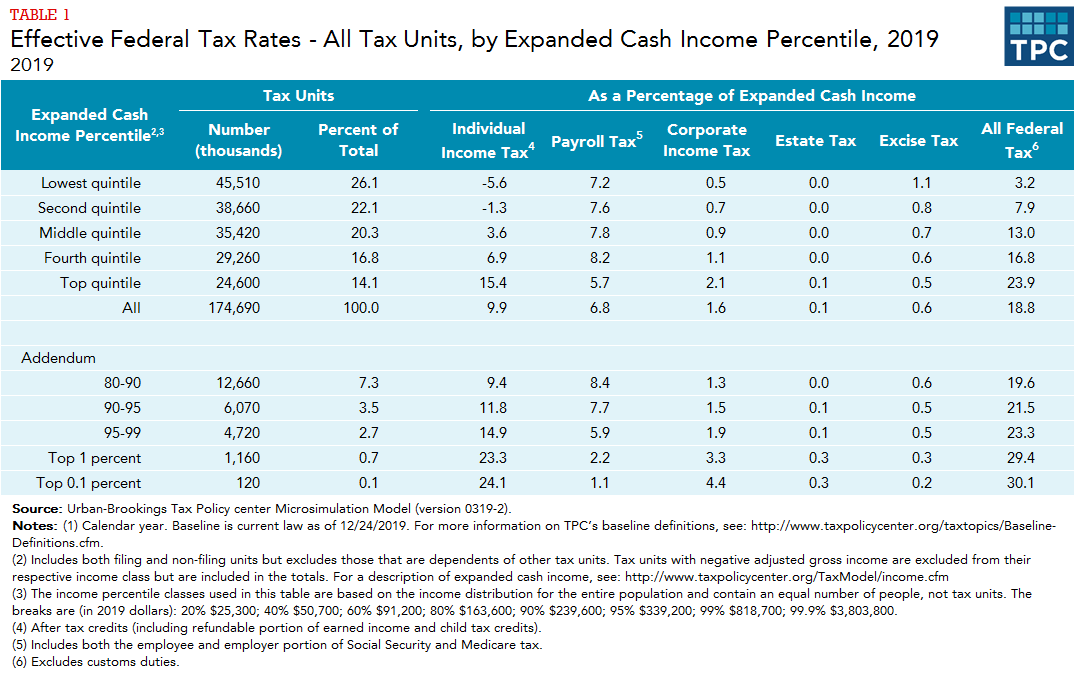

Who Pays U S Income Tax And How Much Pew Research Center

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Average Income Tax Rates Comparisons South African Revenue Service

Montenegro Individual Taxes On Personal Income

Budget Speech 2021 2022 Business Soul Accounting

South Africa Economy Population Gdp Inflation Business Trade Fdi Corruption

South Africa Personal Income Tax Rate 2022 Take Profit Org

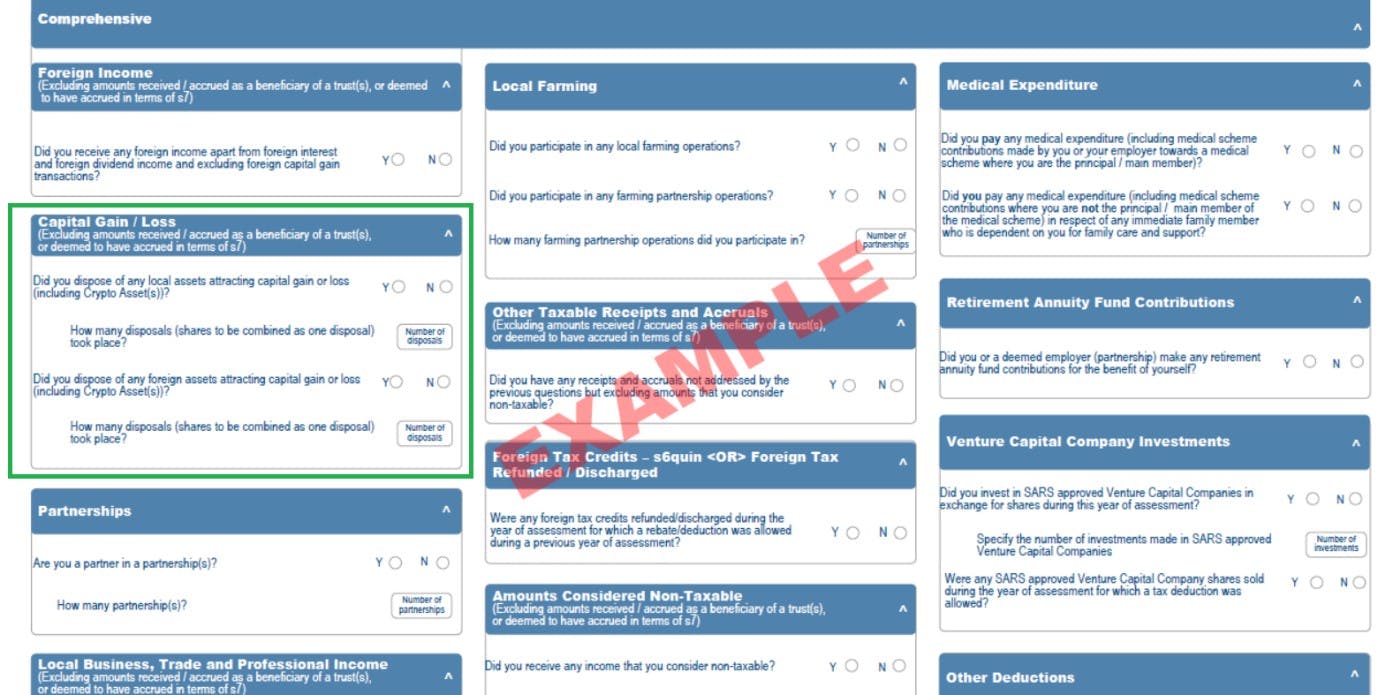

South Africa Crypto Tax Guide How Much You Ll Pay In 2022 Koinly

Budget 2021 Your Tax Tables And Tax Calculator Tgs South Africa

South Africa Budget 2021 Highlights Activpayroll

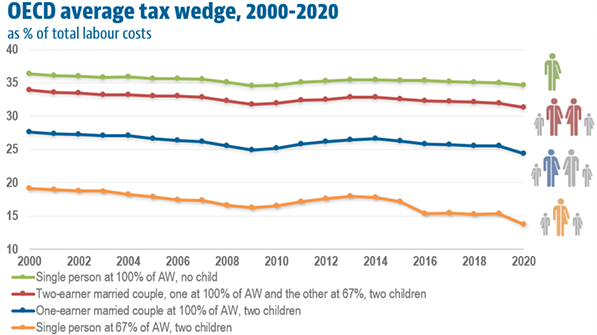

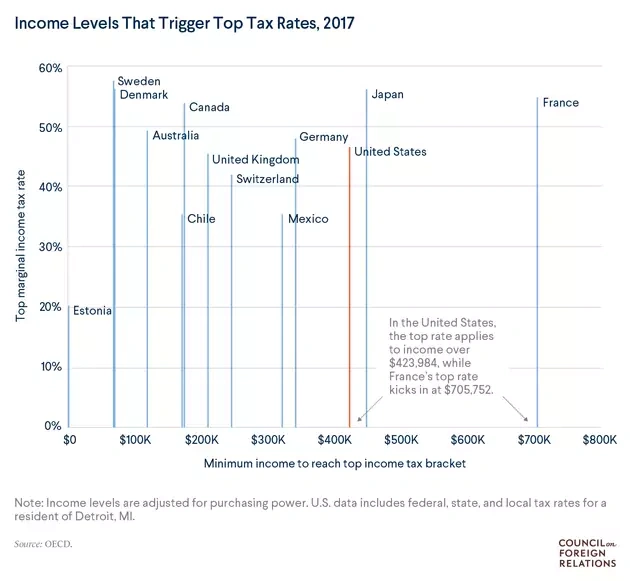

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

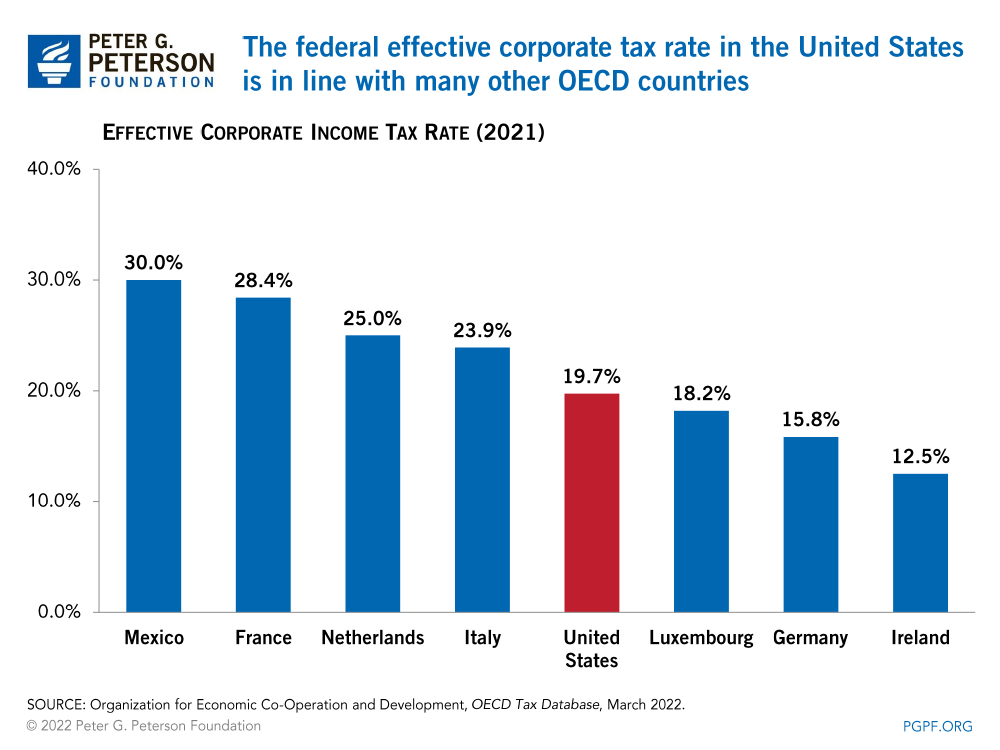

What Is The Difference Between The Statutory And Effective Tax Rate

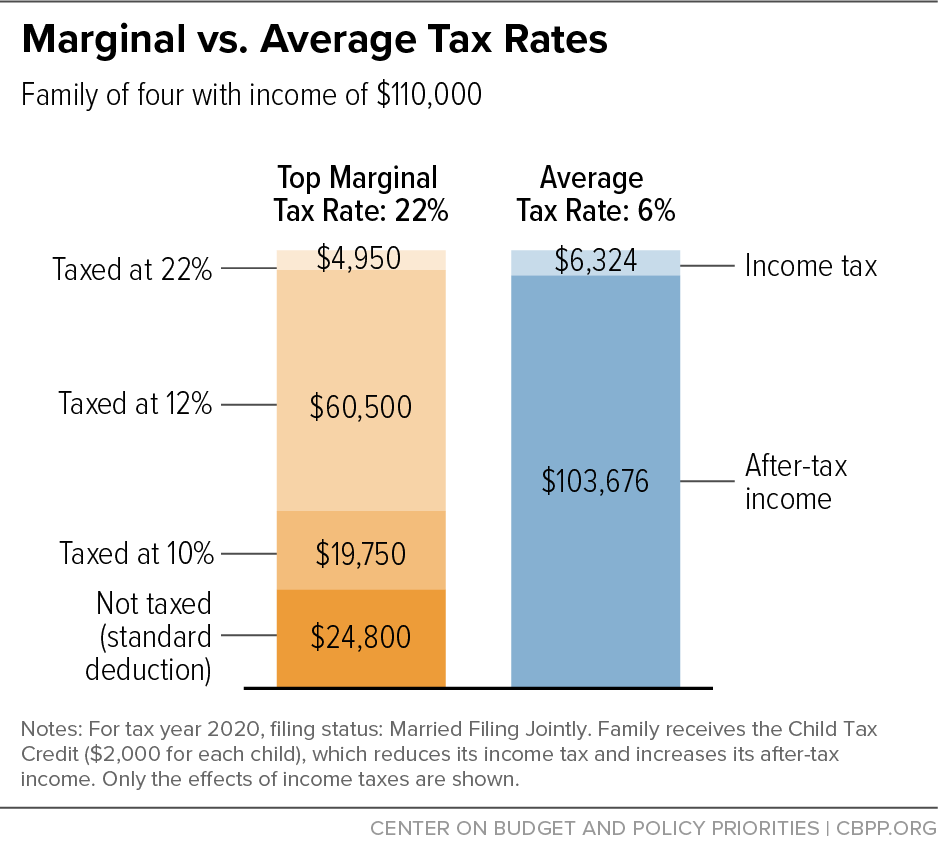

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

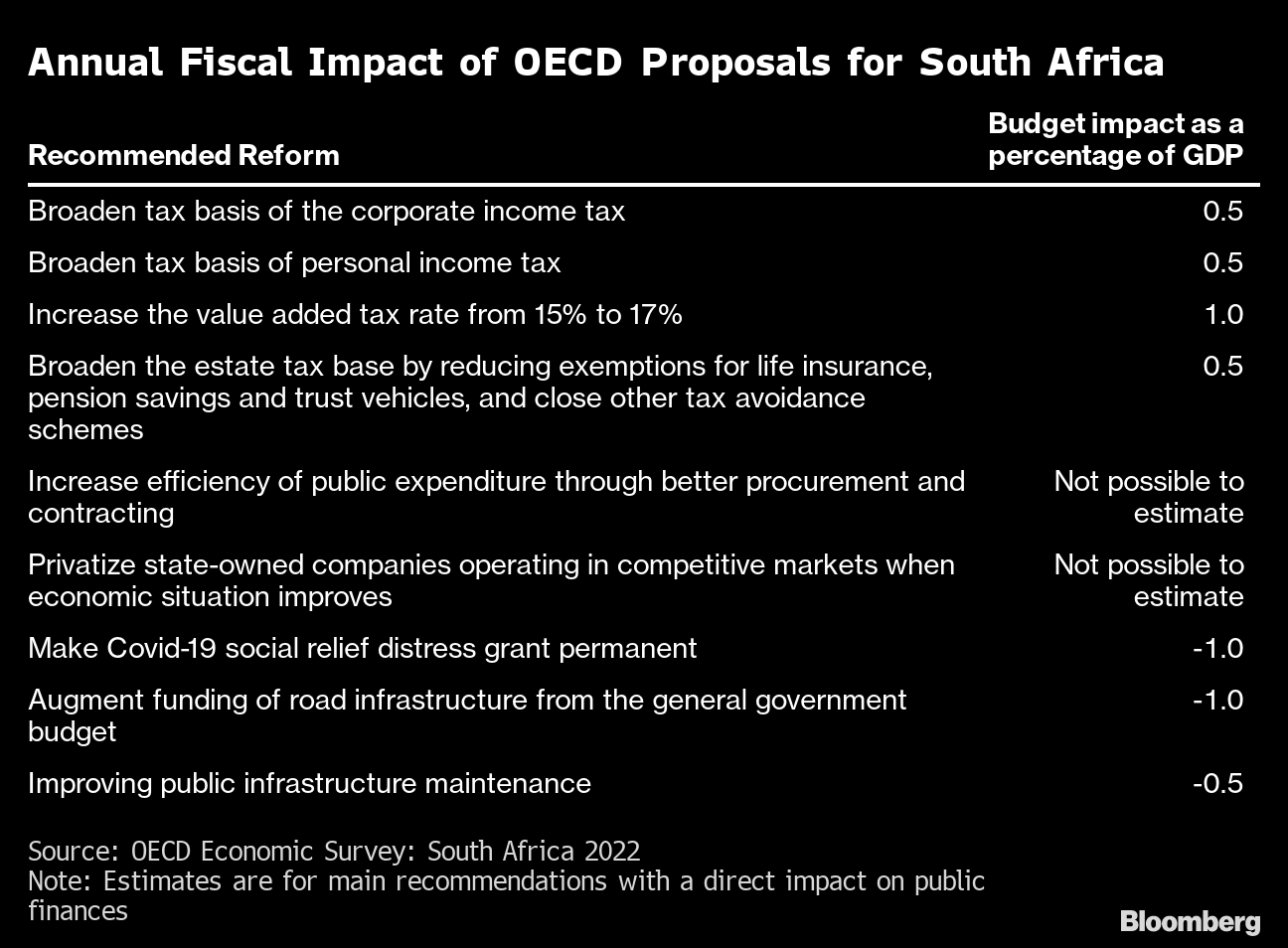

Oecd Urges South Africa To Raise Taxes Sell State Companies Bloomberg

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center